Evolving trends of nation's Gen Z shoppers

Younger Chinese reshape Spring Festival purchasing patterns with focus on personalization, wellness, smart products

Younger Chinese consumers are reshaping Spring Festival shopping trends with a strong focus on personalization, wellness and smart products.

Traditional staples like peanut milk, walnut drinks and mixed porridge — once considered essential for the season — have now landed on the "least wanted" list for Gen Z, those born between the mid-1990s and around 2010.

Tmall's 2024 New Year's Goods Festival Trend Report revealed that post-1995 consumers now account for more than half of all Spring Festival shoppers. Their preferences are driving demand for nostalgic snacks, regional specialties and innovative products, fundamentally transforming how brands approach this festive season.

Younger shoppers are gravitating toward snacks that evoke childhood memories, such as konjac chips, spicy chicken noodles and AD calcium milk. For Melody Song, a marketing professional in Shanghai who returns to her hometown of Dandong in Northeast China every Spring Festival, these treats have a special significance.

"This year, I brought my parents some home accessories themed around the Year of the Snake," said Song. "Spring Festival goods still feel like something from my parents' generation. They take care of everything. I just go home and enjoy the dishes they've prepared for me."

Song's favorite childhood treats, such as strawberry and peach canned fruits or watermelon seeds and pine nuts, hold sentimental value. "No more candy — it's not very healthy," she added.

Regional delicacies are also gaining popularity as meaningful gifts for family and friends. The hashtag "local specialties fueling the New Year's economy" recently topped Xiaohongshu's trending list, showcasing growing interest in Daoxiangcun pastries in Beijing, Ruijin Hotel walnut cakes in Shanghai, and intangible cultural heritage foods like Qiaojiao beef in Chongqing and salted duck in Nanjing.

The festival is also seeing a shift in beverage choices, with juices becoming increasingly popular on New Year tables. Beyond accompanying meals and aiding digestion, fruit and vegetable juices have emerged as a go-to choice for young people seeking to shed holiday weight and maintain healthier lifestyles.

Last year, "liquid salad" topped Douyin e-commerce's Spring Festival sales charts, with monthly sales reaching 40 million yuan ($5.5 million). These low-calorie fruit and vegetable drinks have inspired ready-to-drink tea and beverage brands to innovate, creating a wave of similar health-focused products.

According to the China Shopper Report 2024 by Bain & Company and Kantar Worldpanel, 100 percent NFC (not from concentrate) juice and freshly squeezed juice are replacing traditional low-concentration options, driving consumer upgrades in the juice category.

Spring Festival shopping now goes far beyond traditional foods and beverages. Cultural and creative products, trendy toys and pet clothing are seeing rising demand. JD's Laba Festival Consumption Report showed a 100 percent increase in searches for "Year of the Snake" items, in the first week of Jan compared with that a month ago.

Potted plants like winterberry and silver willow have also become trendy, with transaction volumes on Taobao nearly doubling year-on-year. Meanwhile, smart home appliances and 3C digital products are emerging as standout categories. Douyin data indicates a 40 percent year-on-year rise in GMV (gross merchandise volume) for kitchen appliances and tech gadgets during the season. Popular items include robotic vacuum cleaners, smart drying racks and smart door locks that enhance convenience and modern living.

For instance, Dyson launched a red velvet hair-care product series tailored for the gifting season in China, exemplifying how brands are tapping into festive demand with targeted offerings.

Collaborative marketing campaigns with popular IPs have become a key strategy for brands targeting younger consumers. For example, Lay's potato chip gift boxes featuring Japanese virtual singer Hatsune Miku, and Sanrio-themed Glico products have seen a fivefold increase in festival period sales, according to JD data.

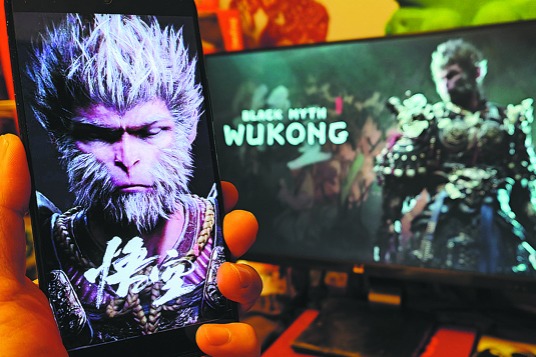

Luckin Coffee's collaboration with the blockbuster game Black Myth: Wukong was another notable success, with special-edition products selling out instantly and generating massive demand.